Case Study

Adaptive Multi-Strategy Equity Algorithm

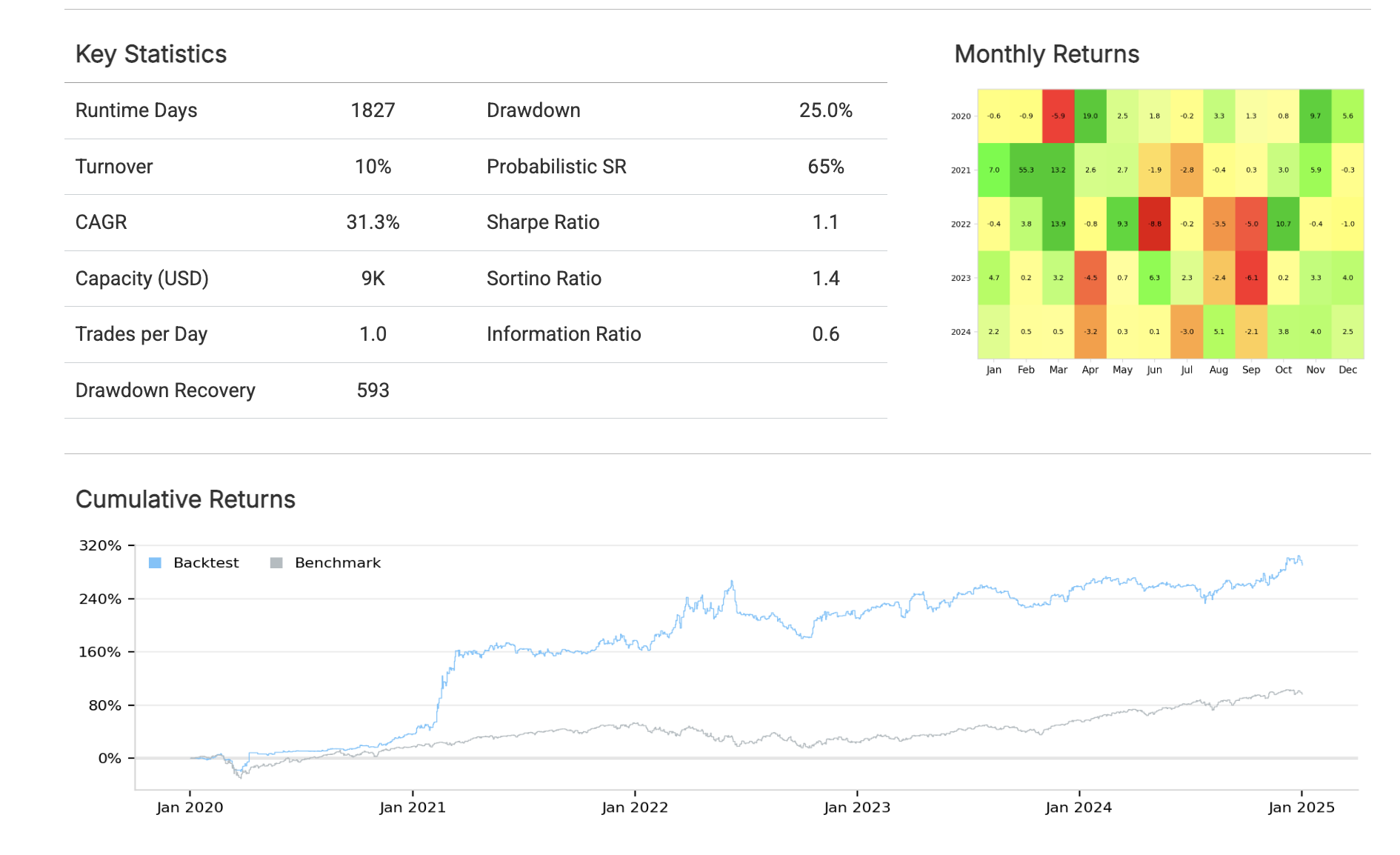

Meaningfully outperformed the S&P 500 benchmark with controlled drawdowns by adapting strategy selection to market regime in real time.

Problem

Most quantitative strategies are optimized for one market environment and bleed when conditions change. A momentum strategy that works in a trending market gives it all back in a choppy tape. A value screen that shines in recoveries can underperform for years during growth-driven rallies. The challenge was building a system that adapts to whichever environment it finds itself in.

Approach

Built three distinct sub-strategies, each optimized for a different market regime. The first is aggressive — it identifies the sectors with the strongest momentum and concentrates into the best setups within them. The second is all-weather — it scores stocks on fundamental quality across the full universe and filters for favorable entries. The third is cyclical — it focuses on energy and industrial stocks that lead during real-economy expansions. Every two weeks, each strategy generates a model portfolio. A meta-layer tracks simulated equity curves for all three and allocates capital to whichever has the strongest recent trajectory. Every position in every strategy must pass through a custom risk/reward analyzer that identifies statistically validated support levels and projects volatility-adjusted targets — ensuring the system never chases a stock without structural backing for the trade. A regime detection layer compares cyclical vs. defensive sector performance to throttle overall capital deployment, parking excess in short-term Treasuries when conditions deteriorate.

Result

The system meaningfully outperformed the benchmark over the backtest period with favorable risk-adjusted returns and controlled drawdowns. The Sortino ratio exceeded the Sharpe ratio, confirming the volatility was skewed toward upside — exactly what asymmetric risk/reward selection is designed to produce. The architecture proved robust across bull markets, corrections, and regime transitions without requiring manual intervention.

What I Learned

The biggest lesson was that architecture matters more than any individual signal. No single strategy worked all the time, but the system for choosing between them did. The pivot-based risk/reward filter was the most important design decision — it kept losses contained even when the directional read was wrong. And the regime throttle, while simple, had an outsized effect on drawdown control by reducing exposure before conditions fully deteriorated.